Toss’s recent moves are turning heads. Originally a simple money transfer service, it has evolved into a comprehensive financial platform. In 2024, the company reported consolidated operating revenue of KRW 1.9556 trillion and operating profit of KRW 90.7 billion, marking its highest revenue ever and its first annual profit since inception. Beyond finance, Toss is also making significant waves in the advertising market, capturing industry attention.

Despite being a relative newcomer, Toss’s advertising business is growing at breakneck speed, posing a real challenge to established platforms.

After ramping up efforts in 2022, its growth trajectory has been steep. Toss now stands alongside major players like Naver, Kakao, YouTube, and Instagram as a key advertising channel. As of November 2023, its monthly ad revenue hit KRW 12.3 billion, a staggering year-over-year increase of over 200%. This success can be attributed to the synergy between Toss’s unique assets and strategic approach. So, how exactly did Toss leap beyond its core financial services to become a new powerhouse in the advertising realm?

📊 Financial Data: The Power of Truly Precise Targeting

Toss’s most potent weapon is undoubtedly its sophisticated targeting capabilities, fueled by financial data. This stems directly from its core identity as a financial platform. With consent from its nearly 19 million users, Toss has access to vast financial data—an asset competitors can’t easily replicate. It goes far beyond simple demographics or interests, leveraging data directly tied to purchasing power and financial behavior: actual asset status, spending patterns, financial product usage, and more. This puts Toss in a different league.

Users’ actual income levels, spending habits, investment tendencies, loan histories, and insurance statuses are powerful indicators that accurately reflect individual lifestyles and purchasing power. Instead of just relying on, say, purchase history for baby products, Toss can target based on more granular, purchase-intent-rich data, such as enrollment in specific financial products like children’s funds or the presence of student loans. For advertisers, this is game-changing: it increases the chances of reaching not just ‘potential leads’ but actual ‘likely buyers,’ decisively boosting ad efficiency. The platform’s 272 finely segmented industry categories further underpin this level of precision.

🎯 Aligning with User Experience: Turning Ads from Annoyance into Value

Advertising inherently risks disrupting the user experience. However, Toss navigates this challenge skillfully. Finding the equilibrium between ‘advertiser satisfaction’ and ‘user ad receptiveness’ is central to Toss’s advertising philosophy. Rather than simply maximizing ad inventory for short-term gains, Toss prioritizes the user experience above all, adopting a long-term strategy to maintain the platform’s value. Concrete practices like weekly A/B testing and applying a ‘Red Line Rule’ embody this philosophy. Ads that negatively impact core service metrics are decisively removed, encouraging users to perceive ads less as intrusions and more as sources of information or benefits.

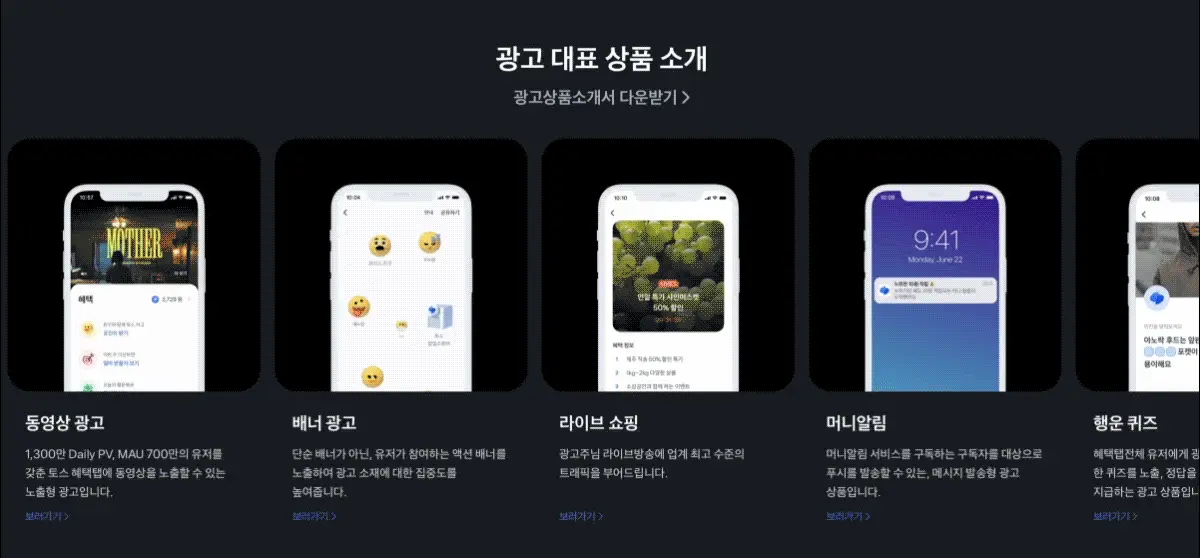

Notably, the reward advertising model, which constitutes a significant portion of Toss’s ad inventory, aligns perfectly with this strategy. Users receive tangible benefits (like points or cashback) for engaging with ads, while advertisers achieve specific, measurable goals (such as app installs, sign-ups, or purchases). This transforms advertising from simple exposure into a ‘win-win’ value exchange for both users and advertisers. Products like ‘Lucky Quiz’ and ‘Brand Cashback’ cleverly gamify participation or directly link rewards to engagement, further enhancing ad effectiveness.

🚀 Fintech Speed and Flexibility: Bringing Agility to the Ad Market

Toss’s rapid execution capabilities and flexible organizational culture, honed as a fintech company, are also significant drivers of its advertising success. The speed at which new ad products move from conception to development and launch is remarkably fast, providing a strong competitive advantage in the rapidly evolving digital marketing landscape. New initiatives, like the Premium Board and live shopping integrations, are rolled out quickly. Furthermore, the speed at which advertiser feedback translates into actual service improvements demonstrates an agility rarely seen in larger, established platforms.

This provides advertisers not just with a diverse range of products, but also with an environment where they can respond flexibly to market shifts and specific campaign objectives. For instance, they can quickly launch new promotional ad formats tied to specific seasons or current events, or easily make real-time strategic adjustments based on data gathered mid-campaign.

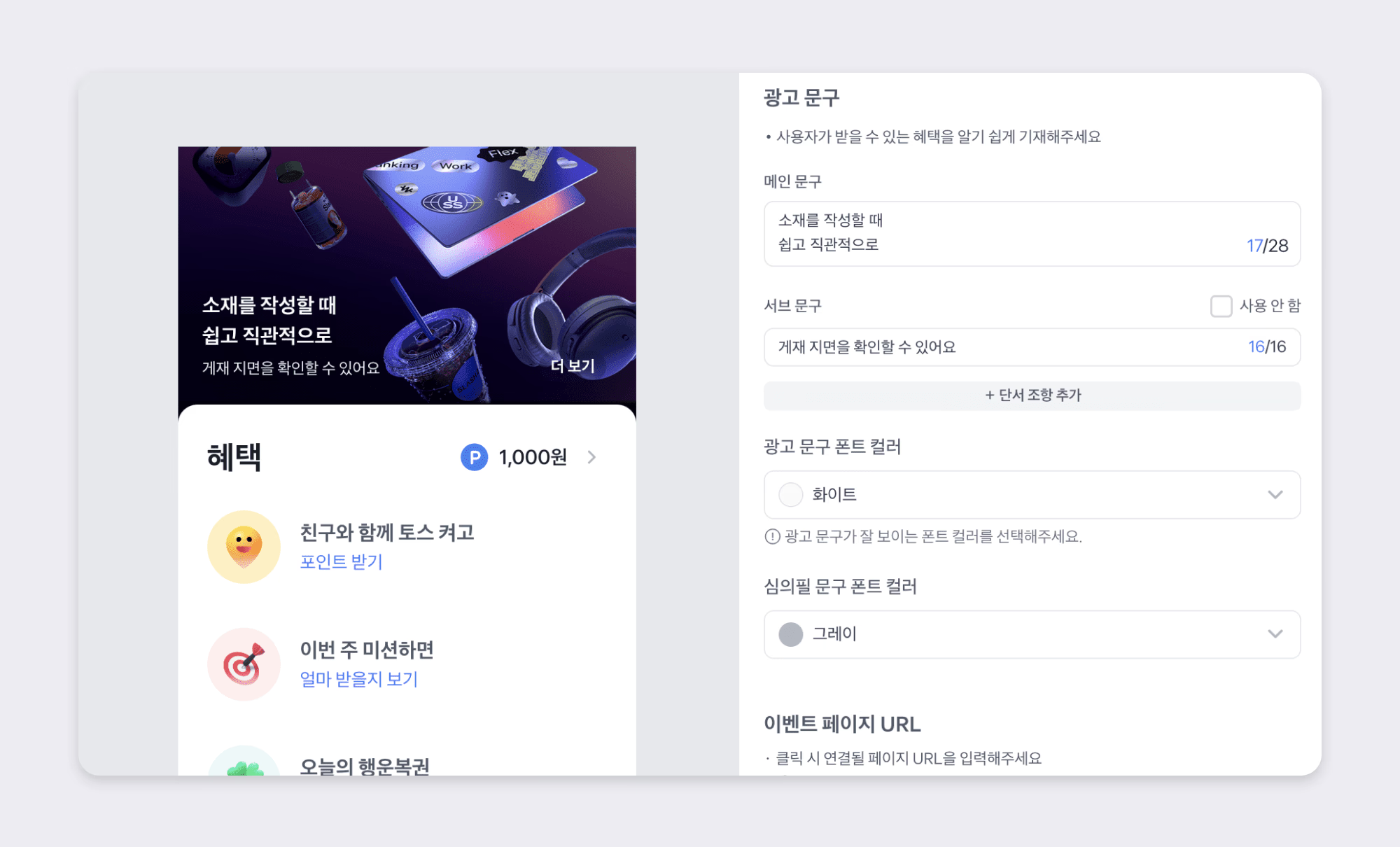

The self-serve advertising platform, ‘Toss Ads,’ further enhances this agility. It empowers advertisers to design and manage their campaigns directly, analyze performance in real-time, and optimize accordingly. This increases transparency and efficiency in ad execution and supports advertisers in making their own data-driven decisions. This is particularly appealing for small and medium-sized businesses (SMBs) operating with limited budgets and resources.

📈 The Synergy of Data, Experience, Speed, and the Road Ahead

Toss’s success in the advertising business isn’t merely due to luck or opportune timing. It’s closer to an inevitable outcome stemming from the powerful combination of: unparalleled first-party data competitiveness derived from its unique identity as a financial platform, a long-term operational philosophy that prioritizes user experience, and the characteristic rapid execution and flexibility of a fintech company. Toss is integrating advertising not just as a revenue stream, but as a vital pillar of its platform ecosystem—one that creates synergy with its financial services, offers tangible benefits to users, and delivers clear performance outcomes for advertisers.

Of course, challenges lie ahead. Potential regulatory shifts concerning the use of financial data, the possibility of competing platforms adopting similar strategies, and the ongoing need to maintain user trust are all areas Toss must continually navigate and address. Nevertheless, it’s clear that Toss’s innovative approach has opened up new possibilities in the digital advertising market. It will be fascinating to watch how Toss continues to blur the lines between advertising and finance, creating new forms of value. How will the future advertising landscape—where the importance of data and user experience only continues to grow—evolve?