Joint Statement: Apple and Google have entered into a multi-year collaboration under which the next generation of Apple Foundation Models will be based on Google's Gemini models and cloud technology. These models will help power future Apple Intelligence features, including a…

— News from Google (@NewsFromGoogle) January 12, 2026

It’s January 2026, and the tech giants are shaking hands again. The rumors have finally solidified into reality: Apple has chosen Google as the definitive partner for its next-generation AI foundation model. It’s a move that has sent shockwaves through the industry, accompanied by a palpable sense of déjà vu.

Naturally, this raises eyebrows. “Isn’t Apple obsessed with vertical integration?” or “Why plant a competitor’s brain inside the iPhone?” These are valid questions. However, a glance at Apple’s history reveals that this isn’t a sudden pivot, but rather the continuation of a calculated, long-term strategy.

Why did Apple momentarily set aside its “Not Invented Here” pride to embrace Gemini? To understand this, we need to look back at the search engine wars of the early 2000s. Let’s dissect how this massive “frenemy” deal is more than just a partnership—it’s a blueprint for survival.

🤝 History Rhymes: The ‘Outsourcing’ DNA from Search to AI

There is an old saying in tech: “History doesn’t repeat itself, but it often rhymes.” The Apple-Google AI partnership is a textbook example. On the surface, it looks like a cutting-edge AI alliance. Peel back the layers, however, and it mirrors the moment Apple integrated Google Search into Safari in the early 2000s.

💡 Rent the Engine, Own the Experience

Apple’s strategic playbook has always been consistent: Control the core interface that touches the user, but ruthlessly outsource the heavy lifting if a dominant player already exists or if the infrastructure costs are prohibitive.

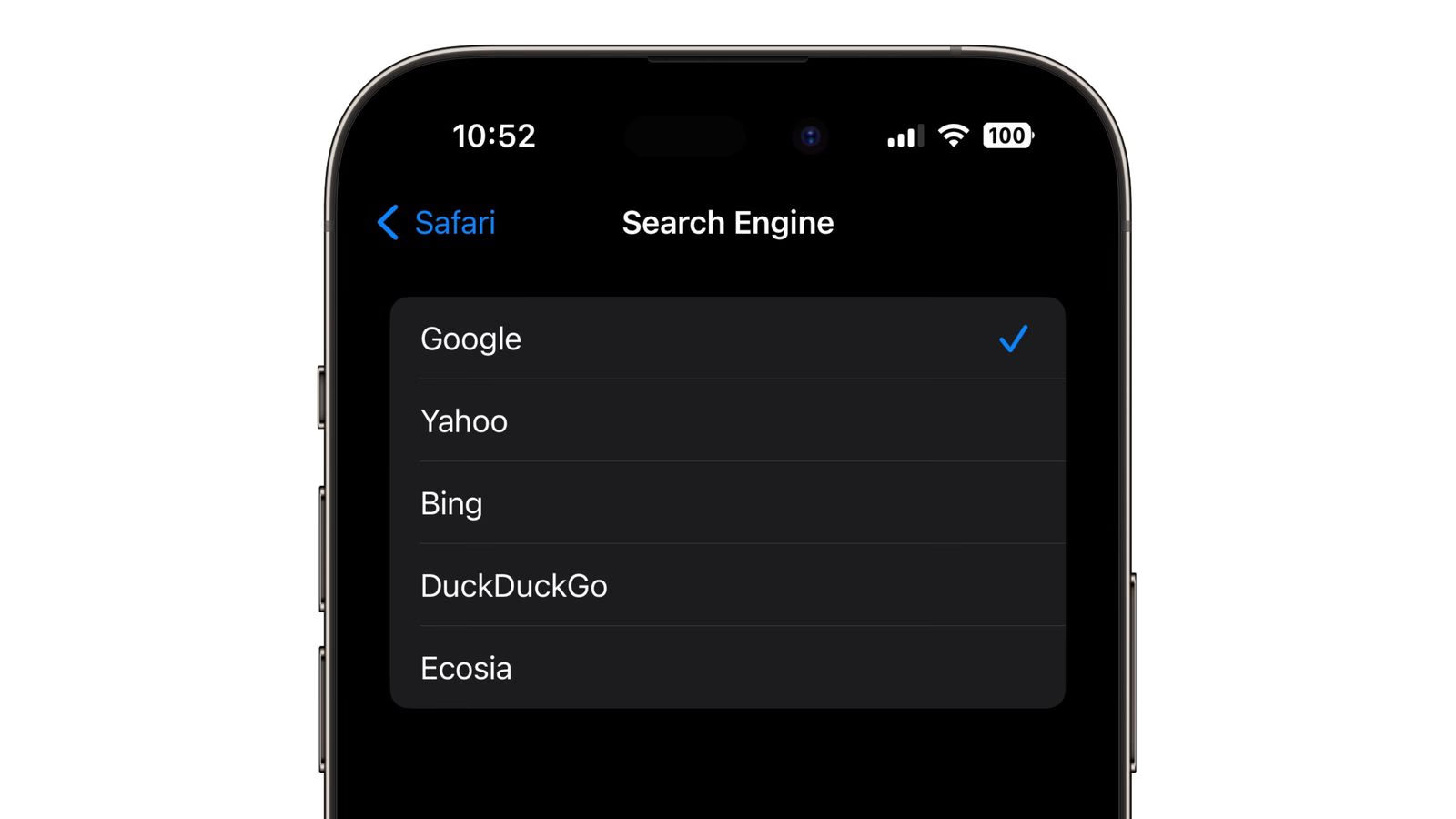

Rewind to 2002. The gateway to the internet was Search. Instead of burning cash to build a search engine to rival Google, Apple simply embedded the best existing search bar into the iPhone and Mac. Maintaining a search engine requires real-time web indexing, massive server costs, and algorithm optimization. Apple chose to direct that energy into hardware design and OS optimization instead.

Fast forward to 2026. The context has shifted from Search to Generative AI, but the logic remains the same. Building a foundation model from scratch requires capital expenditure more akin to heavy industry than software development—hundreds of thousands of H100s (or their successors), securing power grids, and data refining. Apple has done the math: “Google has already spent billions building the Gemini engine. Why reinvet the wheel?”

🏗️ Leave the Backend Complexity to the Experts

If search engines are a battle of indexing and ad platforms, AI models are a battle of training data and inference costs. Both consume astronomical resources behind the scenes.

Apple is sticking to what it does best: Integration and Packaging. Let Google handle the complex math and the heat of the data centers. Apple will take that raw output and wrap it in a polished, user-friendly interface. This is the flexibility of Apple’s vertical integration. It’s a pragmatism that allows them to build what is necessary and borrow what is inefficient to build alone.

💰 From $1 Billion to $20 Billion: The Evolution of the Revenue Model

One fascinating detail of this partnership is the estimated deal size of $1 billion. But don’t look at this number merely as a cost. If we review how the search engine deal turned into a golden goose, we can glimpse the future of this AI transaction.

📈 From Free Tier to 15% of Operating Profit

Initially, the Apple-Google search deal was a pure tech collaboration with little money changing hands. But as mobile traffic exploded, the tables turned. The ad revenue generated by iPhone users became so massive that Google started paying Apple to remain the default search engine.

The figures skyrocketed. From roughly $1 billion in 2014, payments ballooned to $18 billion in 2021, and hit a staggering $20 billion (approx. 26 trillion KRW) by 2022. This “sit back and collect” revenue accounted for 14-16% of Apple’s entire operating profit. The fact that the bulk of the $26.3 billion Google paid to device manufacturers worldwide went into Apple’s pockets demonstrates Apple’s mastery of platform leverage.

⚖️ Turning Legal Risks into Leverage

The recent DOJ antitrust lawsuit was a major threat to this relationship. The court ruled that Google had effectively bought its monopoly. Paradoxically, the September 2025 ruling favored Apple. With the decision allowing Google to continue payments for the time being, Apple gained a strong justification: “We will apply the rules of the Search market to the AI market.”

While it looks like Apple is paying $1 billion to rent Gemini now, this partnership is likely to evolve. As AI search features mature, this deal could mirror the $20 billion search engine model, turning a cost center into a massive profit center.

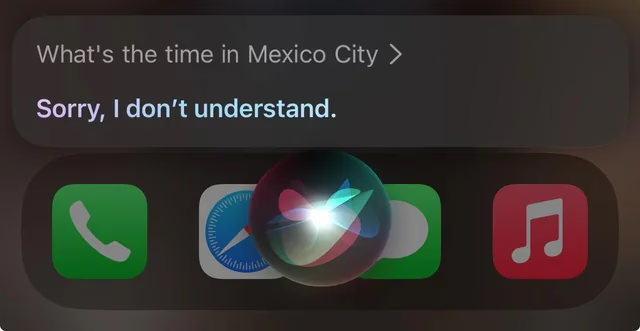

🚀 In Search of Lost Time: Siri’s Savior

By 2024, Apple’s AI strategy was underwhelming, leading investors to fear Cupertino was being left behind. While OpenAI and Anthropic were soaring, Siri was still stuck setting alarms and checking the weather (and often failing at that). Even after the announcement of Apple Intelligence, the critique that they were “lagging behind the competition” was hard to shake.

⏳ Time is More Expensive than Money

The decisive reason for shaking hands with Google is speed. Developing a foundation model to match GPT-4 or Gemini from scratch would take 2-3 years—an eternity in the tech world. If users abandoned the “dumb iPhone” ecosystem during that gap, the damage would be irreversible.

Apple chose pragmatism over pride. By adopting the proven Gemini model, they can instantly elevate the intelligence of the “All-New Siri,” slated for Spring 2026, to industry-leading levels. It’s a return to Apple’s core philosophy: “The user experience comes first.”

🛡️ Privacy: The ‘Together but Separate’ Strategy

The elephant in the room is privacy. “Google eats data for breakfast, and Apple sells privacy. How does this mix?” Here, Apple’s technical cleverness shines.

🔒 Digital Sovereignty

Apple has mandated a Private Cloud Compute firewall as a condition of this partnership. They are using Gemini, but the model runs on instances within data centers under Apple’s control.

Simply put, they are borrowing Google’s brain but keeping it locked in Apple’s house. This is an evolution of the search deal era, where Apple allowed Google Search but used anti-tracking features to protect users.

🏗️ The $600 Billion Picture: Eventually, Buying the House

Is Apple dependent on Google forever? Absolutely not. Apple has announced a massive $600 billion investment in US AI infrastructure starting in 2025. This isn’t just for licensing fees.

Apple is buying time. While Google puts out the immediate fire, Apple is designing Apple Silicon for Servers, building data centers, and refining its own Small Language Models (sLLM). The long-term goal is a Hybrid AI Strategy: handle sensitive data and on-device processing with 100% proprietary tech, and outsource only general knowledge or massive compute tasks to partners.

🔮 The Fine Line Between Competition and Cooperation

The Apple-Google partnership is more than a tech deal. It is a testament to Apple’s pragmatic philosophy: “If you can’t be the best immediately, leverage the best.”

Apple rode Google’s back to dominate the smartphone era with search, and they are applying the same winning formula to the AI era. Users get a smarter Siri immediately. Investors see capital efficiency. And strategically, Apple retains platform dominance while preparing its own infrastructure.

For Google, it’s not a bad deal either. They gain a massive ally in the Apple ecosystem against OpenAI and prove their AI is the industry standard despite antitrust headwinds.

Who is the real winner? Perhaps, thanks to this high-stakes chess game between tech titans, the users—who will finally get a Siri that actually works—might just be the true beneficiaries. I, for one, can’t wait to see what the new Siri has to say in the Spring of 2026.