Coupang Play recently made waves by announcing exclusive live broadcasting rights for the English Premier League (EPL) starting from the 2025-26 season, grabbing industry attention. This follows their already aggressive investments in sports content, having secured rights for major European football leagues like La Liga and Ligue 1, among various other sports. This isn’t just about expanding their content library; it looks like an ambitious gamble by Coupang Play aimed at reshaping the competitive landscape of the Korean OTT market. So, why is Coupang Play going all-in on sports broadcasting rights? And what changes might this bring to the OTT industry?

🤔 Why Did Coupang Play Bet Big on Sports Broadcasting?

Why is Coupang Play pouring significant resources into acquiring sports rights, despite the hefty costs? Several key strategic calculations are likely at play.

First, it’s a core strategy for differentiation against Netflix, the dominant player in the Korean OTT market. While Netflix focuses on original series and movies, Coupang Play has aggressively targeted the relatively open live sports niche. Broadcasting games featuring Son Heung-min’s Tottenham Hotspur or the national team has already paid off handsomely, significantly boosting Coupang Play’s visibility almost overnight. It’s a clear strategy to gain a competitive edge with content unavailable on Netflix.

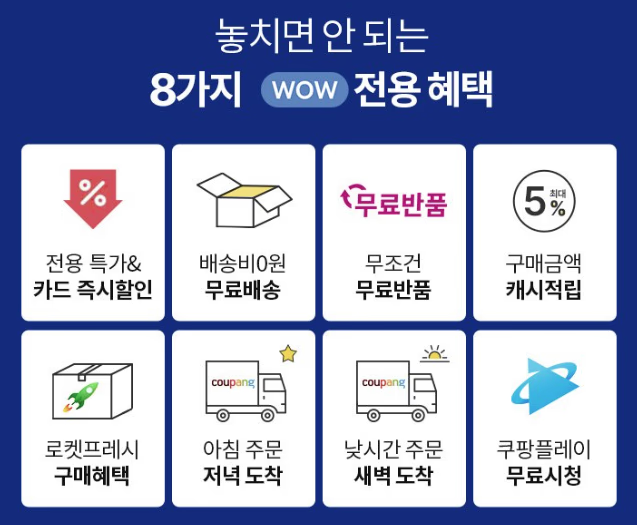

Furthermore, Coupang Play leverages sports content as a powerful tool to enhance the value of Coupang’s core ‘Wow Membership’ and lock in users. Since Coupang Play access is a perk for Wow members, attractive sports broadcasts drive new sign-ups and reduce churn among existing members. As more users maintain their membership to watch their favorite teams, it creates a virtuous cycle, potentially boosting synergy with Coupang’s primary e-commerce business.

Of course, the inherent appeal of sports content itself likely influenced the investment decision. Unlike dramas or movies, sports already boast passionate fanbases, making viewership relatively predictable and ensuring steady demand throughout the season. This helps OTT providers secure stable cash flow and plan long-term. While some might point to the cost-effectiveness of sports compared to the recent surge in K-drama production costs, the astronomical price tags for popular rights like the EPL show this isn’t just about saving money. It’s more likely a decision weighing long-term investment value and strategic importance.

🎯 Winning Over Fans: Strategies for User Growth and Experience Innovation

Coupang Play’s sports investment goes beyond simply buying rights; it’s part of a multi-pronged effort to attract a broader user base and enhance satisfaction.

First, sports content plays a crucial role in expanding the user spectrum. With a significant portion of its existing customer base being female, sports broadcasting serves as a powerful draw for male users. Securing rights for sports popular among the key demographic of men in their 30s and 40s with purchasing power—like soccer, F1, and the NFL—clearly indicates an intent to address this gender imbalance and grow the overall subscriber base.

Another key strategy is diversifying the lineup beyond soccer to include F1, MMA, basketball, volleyball, golf, and more. This reduces the risk of relying solely on one sport’s fanbase and aims to embrace a wide range of sports fans with different tastes, effectively lowering the barrier for various enthusiasts to turn to Coupang Play.

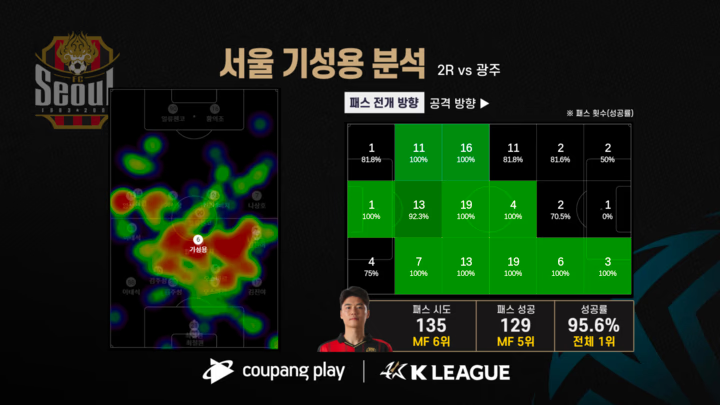

Efforts to innovate the viewing experience itself, moving beyond just showing the game, are also notable. Differentiated broadcasting features developed in-house, like ‘Couplytics’ showcased during K League matches, real-time data overlays during games, and the use of multi-angle cameras for vivid visuals, offer fans more than just ‘watching.’ These enhancements not only boost loyalty among existing fans but also appeal to users previously uninterested in sports broadcasting, transforming Coupang Play from a mere streaming platform into a premier destination for enjoying sports.

🌍 A Heated Battlefield: Global OTT and the Sports Rights Race

Coupang Play’s moves are not happening in isolation; this is a global phenomenon. Giant international OTT companies are also pouring vast sums into securing sports content.

Even Netflix, which once declared it wouldn’t pursue sports broadcasting, signaled a strategic shift by signing a 10-year deal worth around $5 billion for exclusive rights to WWE’s popular ‘RAW’ program. Apple TV+ secured MLS rights and reaped the rewards of the ‘Messi effect,’ while YouTube made bold investments in NFL broadcasting rights, America’s most popular sport.

This global trend clearly shows that live sports content is no longer optional but an essential competitive element in the OTT market. The race to secure sports rights for subscriber acquisition, retention, and service differentiation is only expected to intensify. Within this context, Coupang Play’s sports investments can be seen as a timely and necessary move, aligning with the strategies of global OTT players.

🏁 The Final Whistle Hasn’t Blown: Coupang Play’s Challenge and Future

Coupang Play’s investment in sports broadcasting rights is driven by the clear objectives of differentiating itself from Netflix and strengthening the Wow Membership ecosystem. Indeed, the steady growth in Monthly Active Users (MAU) serves as an indicator that this strategy is paying off. It has also garnered a positive reception from domestic sports fans, contributing to the K League’s recent resurgence.

However, the road ahead won’t necessarily be smooth sailing. Skyrocketing broadcasting rights fees will inevitably pose an ongoing financial burden, and there’s no guarantee that such massive investments will lead to success. Furthermore, counterattacks from competing OTT services are expected to intensify.

In conclusion, Coupang Play’s sports venture is undoubtedly a crucial gamble in the Korean OTT market. Whether this bold bet will firmly cement Coupang Play as a major market player or boomerang back as a costly burden remains an intriguing question to watch.