Ever been planning dinner, only to realize you’re missing just one green onion? In the past, you might have settled for a different dish or begrudgingly made a trip to the supermarket. But things are different now. We live in an age where you can open an app, tap a button, and have the ingredients you need at your doorstep in under 30 minutes. This is the new normal created by Quick Commerce (Q-commerce).

The term “fast delivery” alone doesn’t capture the full scale of the changes Q-commerce has brought. This isn’t just a technological leap in shortening delivery times; it’s a massive paradigm shift that’s reshaping our consumer habits, lifestyles, and even the urban logistics landscape. So, what strategies are the leading companies in this exploding market using to map out the future? And where is this massive trend ultimately headed?

🏙️ The Rise of the New Urbanite and the Ascent of Q-Commerce

The emergence of Q-commerce is deeply intertwined with structural shifts in our society, most notably the explosive growth of single-person households. According to statistics from the Ministry of the Interior and Safety, single-person households in South Korea surpassed 10 million for the first time in 2024, accounting for approximately 42% of all households. Living alone is no longer an exception but the most common household type.

This demographic prefers buying small quantities of what they need right now over bulk items, and they tend to value their personal time over spending it on grocery shopping. Q-commerce perfectly tapped into the needs of this demographic.

Number and Percentage of Single-Person Households by Year

2017 - 2024 (Units: 10,000 households / %)

The contactless culture sparked by the COVID-19 pandemic acted as a catalyst for Q-commerce’s growth. The psychological barrier to ordering daily necessities like you would order takeout—and paying a delivery fee for it—has crumbled. Once consumers experienced the value of “immediacy” and “convenience,” it became difficult to go back to the old way of doing things.

This leads to a powerful “lock-in effect” for specific platforms. A customer who orders from B-Mart today is highly likely to use B-Mart again tomorrow. As such, Q-commerce has become one of the most effective tools for embedding itself in customers’ daily lives and securing their loyalty.

Ultimately, Q-commerce is a service that saves us our most precious resource—time—and allows us to seize the moment when we need something most. The domestic Q-commerce market, valued at around 350 billion won in 2020, is projected to grow to 5 trillion won by 2025, evolving into an indispensable service for modern urbanites.

⚔️ Three Strategies, One Winner: Who Will Come Out on Top?

Today’s Q-commerce market in Korea has become a battleground for three giants with distinctly different strategies: Baedal Minjok, Coupang Eats, and Naver. Each is fiercely competing to dominate the “last mile” of urban logistics in its own way.

1. Controlling Everything In-House: Baemin’s “Direct Model”

B-Mart, operated by Korea’s leading food delivery app Baedal Minjok, is the pioneer of the market and represents the classic Q-commerce model. Its strategy is built on “direct purchasing” and “dark stores.” The company operates around 70 urban fulfillment centers (PPCs, or Picking & Packing Centers) in major cities, where it directly purchases and manages its own inventory. When an order comes in, items are immediately packed and delivered within an average of 30 minutes through its proprietary delivery network.

The biggest advantage of this approach is the ability to maintain consistent service quality by controlling the entire process. From product freshness and inventory management to packaging and delivery times, everything is standardized to provide a uniform customer experience. This direct-sourcing model also allows B-Mart to plan and sell ultra-small quantity items, like a single serving of instant rice or one apple, perfectly targeting single-person households. Recently, thanks to an expanded product line and a higher average order value, B-Mart achieved its first annual EBITDA profitability, demonstrating the potential for this model to be sustainable.

2. Winning with an Ecosystem: Coupang Eats’ “Platform Model”

Coupang Eats initially experimented with a direct model called “Eats Mart” but has since pivoted its strategy significantly. Instead of operating its own fulfillment centers, it now focuses on a marketplace model that connects consumers with local stores like neighborhood supermarkets, butcher shops, and convenience stores. This was a strategic choice to avoid the huge initial investment and high fixed costs of the dark store model, allowing the company to leverage its core strengths: its platform and its “Wow” membership program.

Coupang’s most powerful weapon is its Wow membership, which recently increased to 7,890 won per month. The “free delivery” benefit offered to members effectively eliminates the biggest hurdle for Q-commerce users: the delivery fee. Consumers can get products from local shops delivered without any additional cost.

By recently onboarding GS25 and GS The Fresh to expand its product selection, Coupang Eats is offloading the heavy burden of logistics to local businesses. This allows it to focus on what it does best—customer acquisition and lock-in—thereby achieving both cost efficiency and rapid scalability.

3. Scaling Through Alliances: Naver’s “Coalition Model”

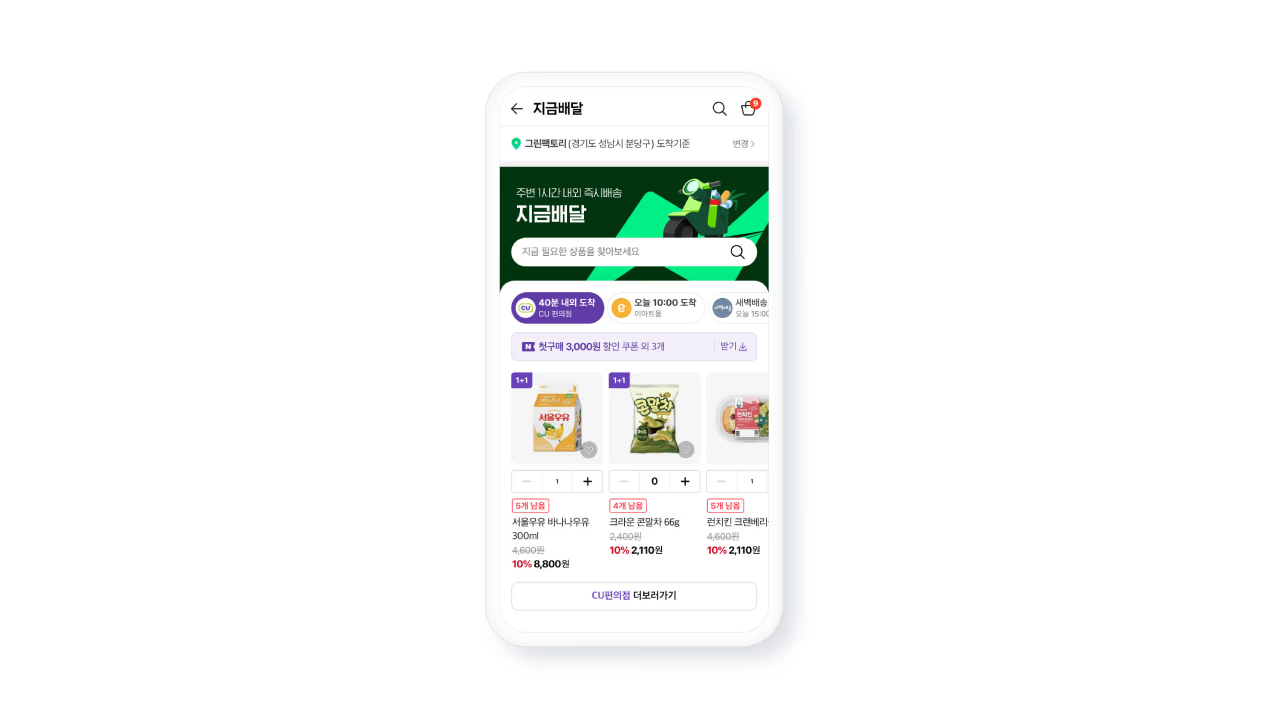

Naver, Korea’s dominant search portal, is taking yet another path. It has no proprietary logistics network or directly sourced products. Instead, it has forged broad partnerships with convenience stores like CU and GS25, and corporate supermarket chains (SSMs) like Homeplus Express and Emart Everyday. Through its “Instant Delivery” service within Naver Plus Stores, users can search for and order products from nearby shops on the web or in-app, and the partnered retailer’s store handles the immediate delivery.

This allows Naver to achieve economies of scale without massive investment, instantly transforming the dense network of convenience stores and supermarkets across the country into its own delivery hubs. This reflects Naver’s typical playbook: building a vast ecosystem by connecting established players in various fields rather than building the infrastructure itself.

💰 The Paradox of Speed: Can This Business Actually Be Profitable?

Beneath the flashy growth, every Q-commerce company faces a colossal challenge: the paradox of “profitability.” The promise of delivery within an hour of ordering inevitably incurs massive costs.

High fixed costs from maintaining dark stores on expensive urban real estate are a given. On top of that, labor costs for pickers, packers, and delivery riders are a continuous strain. When you add in the fierce competition in the form of discount coupons and promotions to attract customers, the cost structure only gets worse.

Because of this reality, it’s nearly impossible to turn a profit delivering a carton of eggs or a bottle of milk. In fact, even B-Mart operated at a loss for years, and many later entrants couldn’t withstand the mounting losses and had to exit the market. So, how are these companies trying to solve this difficult profitability puzzle? The answer lies in multi-faceted strategies that create new value beyond just delivering goods.

The most direct method is to increase the average order value (AOV). Developing high-margin private brand (PB) products to improve profitability and expanding categories to include higher-priced items like cosmetics and small electronics are prime examples. Companies also use tactics like setting minimum order amounts or offering free delivery above a certain threshold to naturally encourage customers to add more to their carts.

Simultaneously, they are making efforts to push operational efficiency to its limits. This includes using AI to accurately forecast demand and reduce unnecessary inventory, as well as optimizing dark store layouts and workflows to cut down on picking and packing times. In the long run, this will lead to logistics automation with robotics, which will be key to fundamentally improving the cost structure.

However, the most fundamental solution lies in creating ancillary revenue streams. A stable cash flow from subscription fees, like Coupang’s Wow membership, is one approach. Another is leveraging the platform’s massive traffic to generate advertising revenue from manufacturers in exchange for better product visibility. This signifies that Q-commerce is evolving from a simple retail channel into a powerful advertising platform fueled by rich customer purchase data. Ultimately, the real reason for enduring the cash-burning speed wars is to lay the foundation for this multi-layered revenue structure.

🚀 Beyond Groceries: A Future of Instant Delivery for Everything

The final destination for the Q-commerce market won’t be limited to just groceries and daily necessities. The dense urban logistics networks and rapid delivery capabilities they’ve built possess limitless potential for expansion by integrating with other industries.

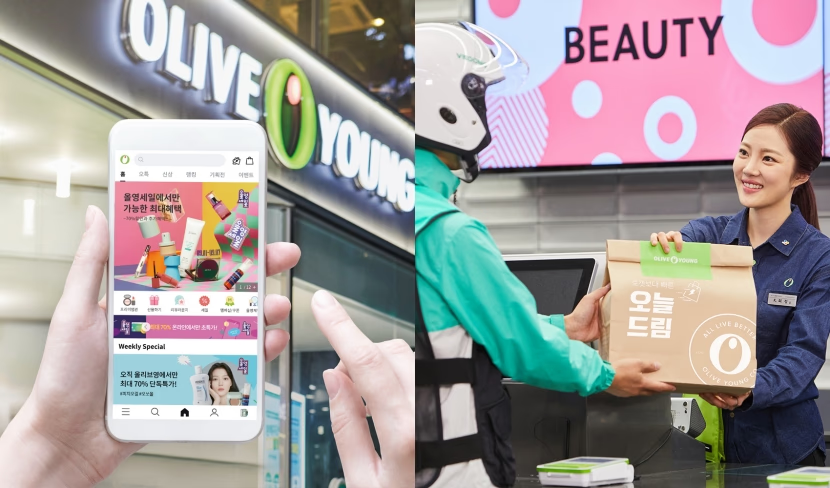

A prime example is “Today’s Delivery” from CJ Olive Young, a leading health and beauty retailer. By leveraging its nationwide network of offline stores and urban fulfillment centers, it delivers cosmetics in an average of 30-50 minutes, emerging as a new powerhouse in the Q-commerce space. More recently, the popular variety store chain Daiso has resumed its “Today’s Delivery” pilot service in some areas, signaling an expansion into the general merchandise market.

In the near future, it’s widely believed that Q-commerce will become even more commonplace, with services like over-the-counter medicine delivery in partnership with pharmacies and new book releases from bookstores. Ordering office supplies or small electronics you need urgently at work will also become second nature. There is also the potential to evolve into “hyper-local” all-in-one platforms that cover all aspects of daily life, including laundry pickup and delivery, small-item courier services, and meal kit services that deliver recipes and ingredients from local restaurants.

At its core, the Q-commerce war is about more than just who can deliver the fastest. It’s a battle to see who can become the essential life infrastructure that solves all of an urbanite’s immediate needs.

🛵 Beyond Speed: It’s Time to Prove Value

Q-commerce has ridden the wave of societal trends like the rise of single-person households and the growth of contactless culture to become deeply embedded in our lives. Baedal Minjok, Coupang Eats, and Naver are vying for market supremacy with their respective direct, platform, and coalition models. Their competition is fueling the market’s growth while providing consumers with ever-greater convenience.

However, the market is now shifting from a race for speed to a test of value. Overcoming the burdensome cost structure to build a stable business model and establishing themselves as an indispensable urban service beyond grocery delivery is the shared challenge that lies ahead for all of them.

The future winner of the Q-commerce market won’t be the company that simply delivers goods the fastest. It will be the one that best understands customer data, uses technology to achieve maximum operational efficiency, and, through clever integration with other services, becomes the one that is most deeply integrated into our daily lives.