Think about the payment terminals at your local café or restaurant: clunky designs, confusing buttons, and that familiar routine of swiping your card multiple times just to get a response. While so much of our world has gotten smarter over the past few decades, payment terminals seem to be stuck in a time warp. This is the familiar, frustrating landscape that Toss Place is here to challenge.

Just as Toss rewrote the rules of online finance, Toss Place is posing a new question to the market for payment terminals—the heart of any brick-and-mortar store. This isn’t just about making a prettier machine. It’s the opening act of a grand strategy to fundamentally reshape the dated offline payment experience, revolutionize how millions of small business owners operate, and ultimately, weave the Toss brand into the fabric of our daily lives, moving beyond the digital realm. So, what does the future envisioned by Toss Place look like?

📱 From ‘Machine’ to ‘Experience’: Redefining the Payment Terminal

“Why do payment terminals have to be so difficult to use?”

Toss Place started with this simple yet crucial question. The legacy market has long prioritized stability over innovation, showing little interest in adding new features or improving design. As a result, store owners have been forced to spend valuable time learning complicated systems, while employees work under the constant stress of making a mistake.

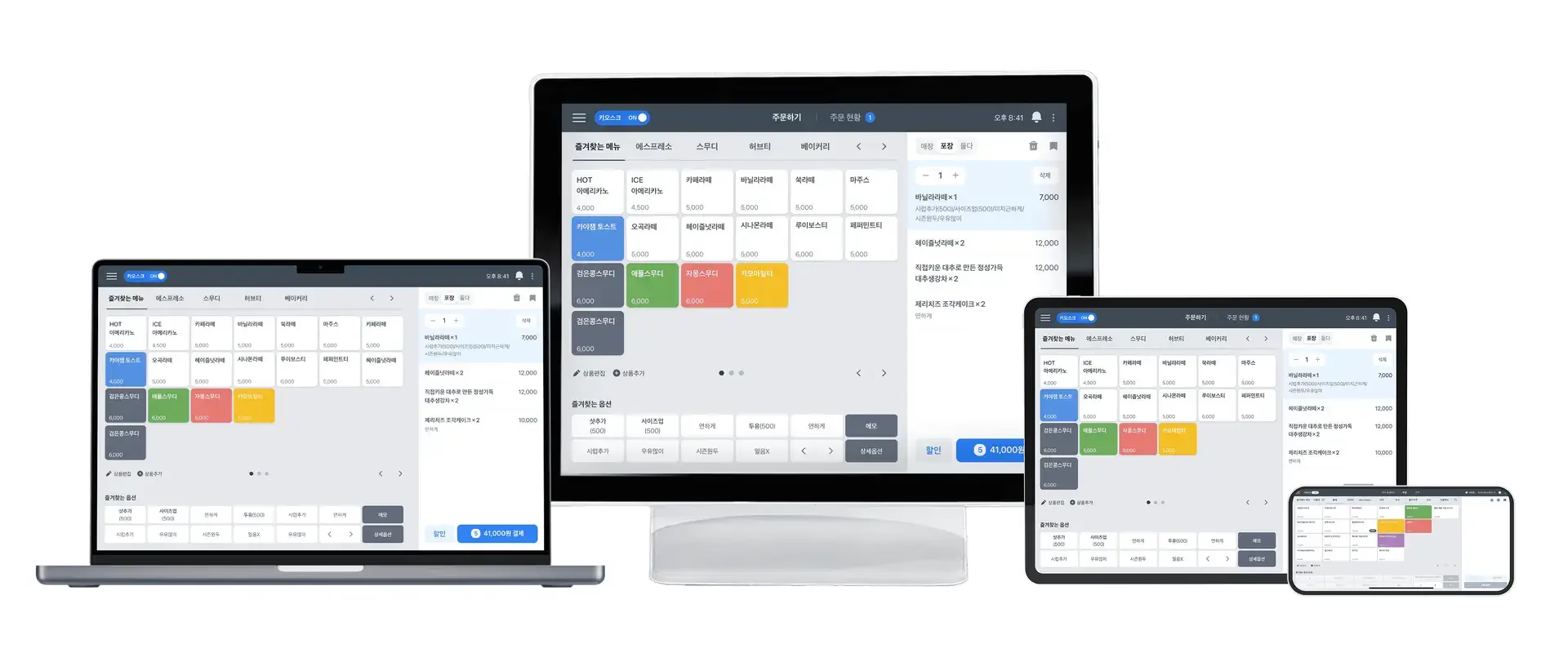

Toss Place zeroed in on this pain point. Its ‘Toss Front’ terminal, with its intuitive, vertical display reminiscent of a smartphone, is designed not just to look good, but to maximize operational efficiency. Customers can clearly see their order details, and owners can use the large screen for membership management or simple order processing. It’s as easy to use as a smartphone app, requiring virtually no training for anyone.

Another key differentiator is ‘Toss POS,’ the free store management software. Previously, businesses had to purchase expensive, dedicated hardware for their point-of-sale systems. Now, they can simply install an app on a standard PC or tablet. Updates are also seamless, available through the Play Store or App Store without needing a technician to visit. This offers a tangible benefit by dramatically lowering the initial investment and maintenance burden for small business owners. Ultimately, Toss Place is redefining the payment terminal from a simple ‘payment processing machine’ to a ‘smart business partner’ that assists with every aspect of store management.

🗺️ The Big Picture: A B2B Platform for the Multi-Hundred-Billion-Dollar Offline Market

Toss’s entry into the massive offline payment market—valued at over 500 trillion won (approx. $360 billion)—isn’t just about the market’s size. There’s a much more sophisticated strategy at play. The payment terminal is the final touchpoint between a store and its customers, making it a goldmine of critical data.

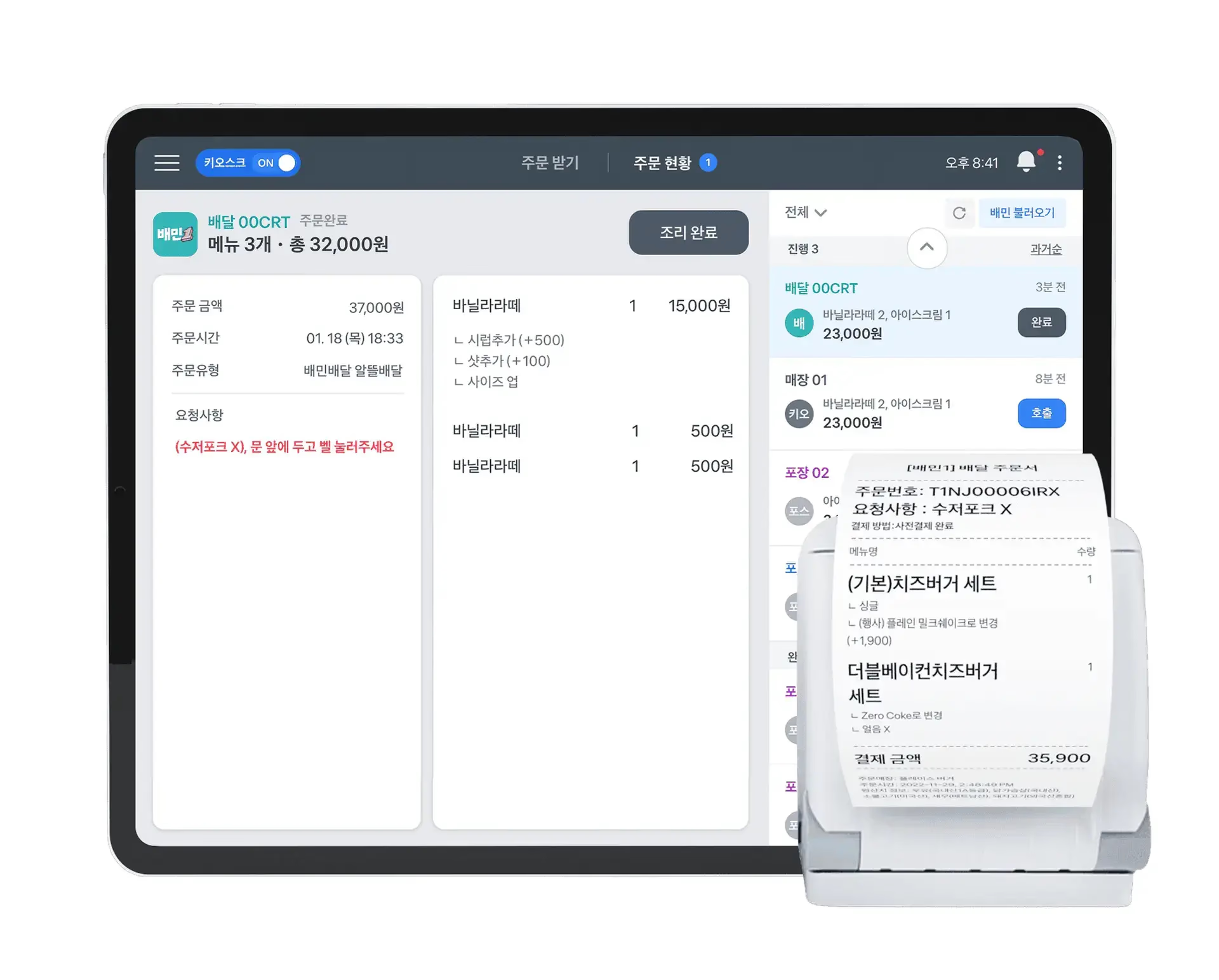

By capturing this touchpoint, Toss Place is painting a big picture of evolving beyond simple payment processing fees and becoming a B2B platform for brick-and-mortar businesses. The payment terminal is the gateway to this platform. For example, by analyzing payment data on what products sell and when, it can help with inventory management. Based on customer visit data, it can suggest personalized marketing or loyalty programs.

The initial integrations with salon management software and food delivery apps are the first steps in building this ecosystem. In the future, as specialized solutions for pharmacies, clinics, and private academies are implemented on Toss Place terminals, business owners will no longer need to juggle multiple complex programs. They’ll be able to handle bookings, payments, customer management, and marketing all from one place. This will position Toss Place not as a mere hardware supplier, but as an essential Software as a Service (SaaS) provider that helps small businesses thrive.

🚀 The Most Realistic Stepping Stone to a ‘Face Pay’ Future

Perhaps the most exciting aspect of Toss Place’s strategy is its connection to ‘Toss Face Pay’—facial recognition payment. Considering that Toss has identified face pay as its core focus for the next decade, the current rollout of payment terminals is the most critical infrastructure build-out for the future.

Toss Place Merchant Locations Nationwide

Data from Dec 2023 to Dec 2024

No matter how revolutionary a payment technology is, it’s useless without offline terminals to support it. To popularize Face Pay, Toss has opted for an ‘infrastructure-first’ strategy: install as many of its terminals in stores across the country as possible. This explains why the company is currently focused on growing its merchant base rather than on immediate profitability. Following its initial launch of Face Pay in convenience stores in February, a pilot program is being introduced in 20,000 locations across Seoul, helping it quickly become a part of daily life. The current terminal expansion is the most realistic and calculated move to pave the way for this massive shift.

📈 Can an Online Finance Giant Conquer the Offline World?

The journey for Toss Place has just begun. While its growth to over 85,000 merchant locations is impressive, this is still just a fraction of the total small business market. The true success of Toss Place won’t be measured by the number of terminals installed. It will depend on how many business owners experience tangible improvements in their operational efficiency and come to see Toss Place as a partner that helps them grow their business.

Ultimately, Toss Place has an ambition that goes beyond replacing old hardware: it aims to become the operating system for offline retail. It envisions being the central hub for everything from payments and data analysis to marketing and the future of new payment methods. It’s worth watching how Toss, a digitally native company, will transform the landscape of the most analog of spaces: the local neighborhood store. On top of that sleek, simple payment terminal you see every day, the future of offline business may be getting rewritten.