In February 2025, Netflix boldly announced a new strategy: a 5-day weekly variety show lineup. Much like traditional terrestrial TV, they’re set to drop new variety content every evening. Titles like ‘Weekly Restaurant Critique,’ ‘Drive It Crazy,’ ‘DongMiSae: Freshmen Obsessed with Clubs,’ ‘Try This Try That,’ and ‘Crazy Delicious: My Foodie Friend’s Picks’ are already sparking curiosity. This new move from Netflix isn’t just about expanding their content library; it seems they’re aiming for a major overhaul of viewer consumption habits and a significant shift in the entire broadcasting market.

🧐 Why is Netflix Suddenly Hooked on Weekly Variety?

Catering to Korean Viewers’ Habit of Tuning in Weekly

Netflix’s decision to launch weekly variety programming stems from a deep understanding of Korean viewers’ unique content consumption habits. Yu Ki-hwan, Director of Non-Fiction Content at Netflix Korea, explained that the initiative began with the desire to showcase entertaining variety shows daily, tailoring to Korean subscribers’ preference for weekly TV viewing. We all probably have memories of tuning in every weekend for shows like ‘Infinite Challenge’ or ‘1 Night 2 Days,’ right?

Netflix is directly tapping into this. They realized that their existing model of releasing entire seasons at once wasn’t satisfying viewers’ ingrained habit of weekly tune-ins. So, they’ve opted for a terrestrial TV-style, day-of-the-week variety schedule, aiming to lure viewers to visit Netflix every single day. It’s essentially a Korean-tailored strategy.

From ‘Binge-Watching’ to ‘Weekly Tune-In’? A Strategy Shift

This move by Netflix signifies a fundamental shift in their content delivery strategy. Historically, Netflix has pursued a ‘binge-watching’ strategy with original series like ‘Squid Game’ and ‘The Glory,’ releasing entire seasons at once. Even variety shows like ‘Physical: 100’ and ‘Single’s Inferno’ followed a season-based release, dropping episodes over 2-3 weeks and then concluding.

However, the 5-day weekly variety schedule is completely different. By consistently delivering new episodes weekly, they’re focusing on increasing platform ‘dwell time’ and boosting ‘subscriber retention rates.’ It’s a strategy that prioritizes ‘consistency’ over a ‘one-hit wonder’ approach. The idea is to make watching Netflix variety shows a weekly ritual, just like eating regular meals.

Maximizing Ad-Supported Tier? Netflix’s Hidden Card

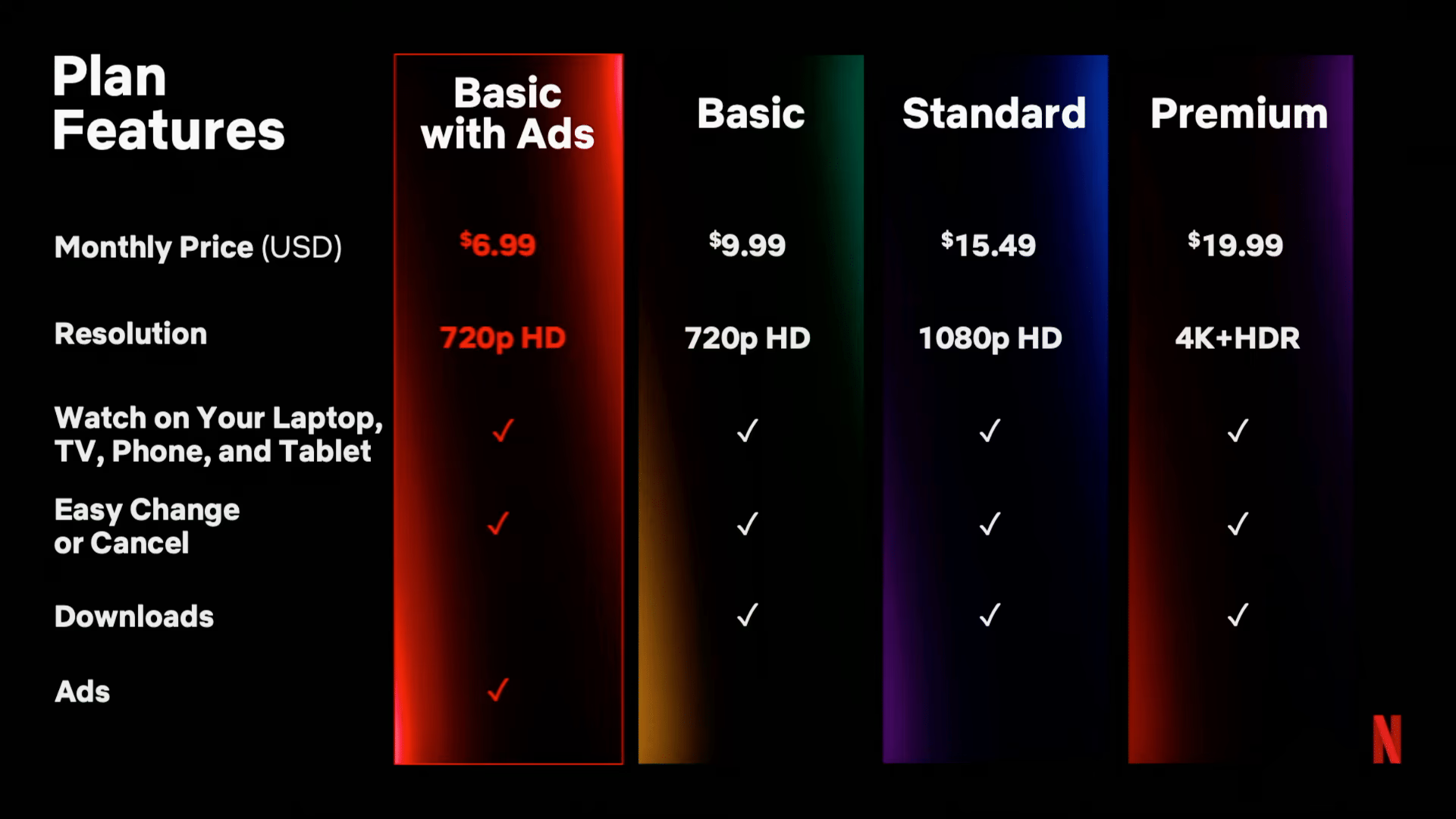

Another crucial goal behind Netflix’s weekly variety programming is strengthening their ‘advertising revenue model.’ In 2022, Netflix introduced an ad-supported tier, securing a new revenue stream. The ad-supported model is structured so that ad revenue increases with viewing time.

Weekly variety programming is an effective way to boost viewing time. With fresh variety content updated every week, viewers are more likely to visit Netflix frequently, naturally increasing ad exposure opportunities. Notably, Netflix announced encouraging results for Q4 last year, with ad-tier subscriptions increasing by 30% compared to the previous quarter, and 55% of new subscribers opting for the ad-supported plan. Weekly variety programming can be seen as a strategy to further accelerate the growth of this ad-supported model.

Taking on YouTube with ‘Mealtime Companion Variety’

Netflix’s weekly variety strategy isn’t solely aimed at competing with traditional broadcasters. Analysts suggest that their real target is ‘YouTube.’ In fact, Netflix is promoting these new variety shows as ‘mealtime companion variety’ – YouTube-style content that’s perfect for casual viewing while eating.

‘Weekly Restaurant Critique’ features Moon Sang-hoon of the hugely popular YouTube channel ‘Ppadooner,’ and ‘Crazy Delicious’ stars singer Sung Si-kyung, known for his love of food. This suggests Netflix is actively leveraging popular YouTubers and formats to draw YouTube viewers to their platform. Ultimately, Netflix seems to be declaring a head-on competition with YouTube.

📺 Netflix’s Variety Show Tsunami: What’s the Fate of Terrestrial TV?

Netflix’s Aim to Dominate Beyond Dramas, into Variety

Netflix’s weekly variety programming is a direct challenge to the long-established variety show market of terrestrial TV. In the drama market, terrestrial broadcasters are already being overwhelmed by Netflix’s immense capital and platform power. Unable to cope with skyrocketing drama production costs, broadcasters are increasingly scrapping weekday drama slots.

If Netflix manages to dominate the variety market as well, terrestrial broadcasters could face an even more severe crisis. Netflix is likely to invest massive production budgets, poaching top-tier PDs (Producers/Directors) and popular variety stars, and churning out variety shows with groundbreaking formats. This would inevitably lead to a weakening of terrestrial TV variety shows’ competitiveness, driving viewers to turn to Netflix even more.

YouTube vs. Netflix vs. Broadcasters: The Dawn of a Media Three-Way Battle

Netflix’s weekly variety strategy could completely reshape the existing competitive landscape of the broadcasting market. Previously, the competition was primarily among terrestrial broadcasters, cable channels, and general programming channels. Now, it could evolve into a three-way battle in the media landscape between YouTube, Netflix, and traditional broadcasters.

Notably, Netflix is adopting a strategy that absorbs the strengths of both YouTube and traditional broadcasters. They’re creating short, snackable variety content like YouTube, while also utilizing the systematic programming, star PDs, and popular celebrities of traditional TV. This hybrid strategy has the potential to make Netflix a true game-changer in the media market.

Glamorous Revival of Canceled Shows

Another intriguing aspect of Netflix’s weekly variety push is the revival of ‘Hong Kim Dong Jeon,’ a show that was canceled by KBS due to low ratings, now reborn as Netflix’s ‘Drive It Crazy.’ It immediately topped the popularity charts upon release. This demonstrates that content overlooked on TV can achieve success on OTT platforms. OTT platforms have a much wider audience reach than TV, and algorithms can maximize content exposure. We can expect to see more examples of shows canceled on traditional TV being reborn and thriving on OTT platforms.

🤔 Can Netflix’s Weekly Variety Strategy Succeed?

‘Production Budget Bomb’ – What if it Hits Variety Shows Too?

Just as Netflix dramas have driven up Korean drama production costs and star salaries, there are concerns that Netflix variety shows could follow the same path. If Netflix pours massive budgets into variety show production, it could inflate overall variety production costs, burdening smaller production companies and broadcasters.

Furthermore, if top stars and popular PDs flock to Netflix variety shows, traditional broadcasters may find it increasingly difficult to secure competitive talent. There’s a critical perspective that Netflix’s money war could devastate the Korean variety show ecosystem.

Accelerating Shifts in Media Consumption Patterns

Netflix’s weekly variety strategy could further accelerate the already rapid shifts in media consumption patterns. Younger generations are increasingly viewing TVs not as simple ‘broadcast receivers’ but as displays for OTT services like YouTube and Netflix.

If Netflix successfully absorbs TV viewers with its weekly variety shows, TV could increasingly become relegated to a ‘set-top box’ status, and traditional broadcasters could be completely pushed out of the platform competition. Netflix’s experiment is more than just a variety show revamp; it could be a critical turning point shaping the future of the media industry.

📈 Will Netflix’s Experiment Reshape the Media Ecosystem?

Netflix’s 5-day weekly variety programming strategy is a complete reversal of their previous approach. If this experiment succeeds, Netflix could become more than just a content provider; they could become a game-changer completely reshaping the media ecosystem. By simultaneously achieving subscriber retention, increased ad revenue, and a challenge to YouTube, they could gain an overwhelming advantage in the Korean media market. What other fresh content will they unleash next to conquer the Korean market?