While reading the details for Toss’s 10th app anniversary event, ‘Square of Toss,’ something interesting caught my eye. It mentioned that registering for FacePass would allow faster entry to sessions via facial recognition. I also remembered getting a push notification saying that pre-registering my face would enable quicker use of Face Pay. Digging a bit deeper into facial recognition, it turns out both Toss Pay and Naver Pay are actively pushing to introduce facial payment systems into the offline payment market. Is this move just a display of technological prowess, or perhaps another fleeting trend meant to grab consumer attention?

⚡️ Offline Payments Get a Tech Makeover

The Evolution of Digital Payments: How Far Have We Come?

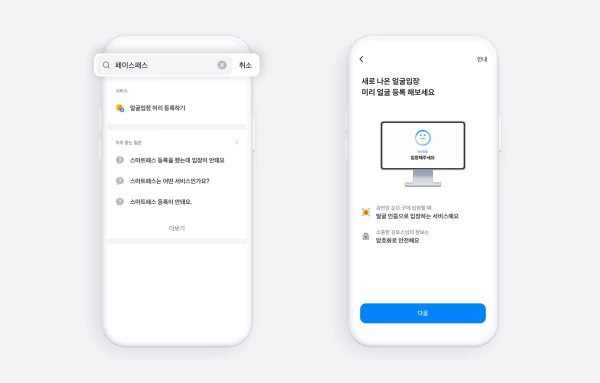

Looking back, digital payments have been woven into our lives for quite some time now. Cash and credit cards gave way to mobile payments like Samsung Pay and KakaoPay, which are now the norm. We’ve moved beyond QR codes and NFC, entering the new territory of biometric authentication. Facial recognition technology, in particular, is emerging as the core of touchless payments, evolving to minimize physical contact during transactions while maximizing user experience and convenience. Systems like Toss’s ‘Face Pay’ or Naver Pay’s ‘Face Sign,’ which enable payments using only facial information, are no longer science fiction but a reality.

Facial Recognition: How Smart Has It Gotten?

The heart of any facial payment system is undoubtedly the facial recognition technology itself. Toss and Naver are betting heavily on advancing this tech. AI algorithms are standard, and they claim to have pushed facial recognition accuracy up to 99.99% – practically flawless.

What’s interesting is that they’re not just recognizing faces; they’ve also beefed up security. Toss uses ‘Liveness detection’ technology to prevent spoofing with photos or videos, while Naver Pay employs 3D facial scanning and encryption techniques to enhance safety. From a consumer standpoint, the biggest worry is likely, “Could my facial data be misused?” It’s clear these companies are meticulously addressing these anxieties with technological safeguards.

🚀 Why the Hype Around Face Pay Now?

The Offline Market: Still Full of Opportunity

Some might think, “Online shopping dominates, so why focus on offline payments now?” However, statistics show the offline market remains a significant force. According to Bank of Korea data, the average daily volume of offline, in-person payments in 2024 reached ₩1.7 trillion (approx. $1.3 billion USD). That’s considerably larger than the ₩1.2 trillion (approx. $0.9 billion USD) for non-face-to-face payments. This is precisely why Toss and Naver Pay are eyeing the offline market.

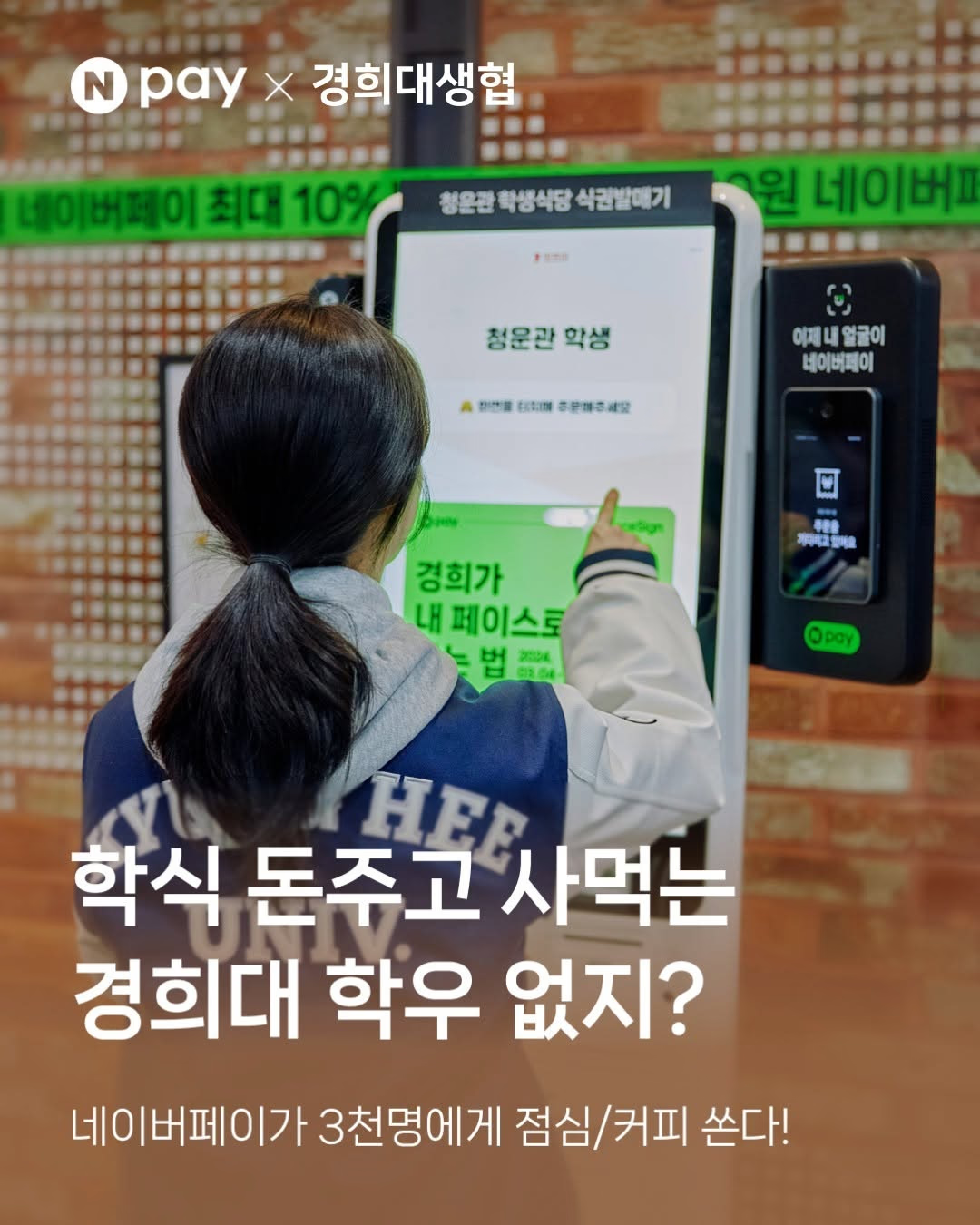

Essentially, they’re deploying facial payment as a new weapon to compete in the offline payment arena currently dominated by Samsung Pay. Their strategy of targeting places with frequent, repeat purchases in daily life, like convenience stores and university campuses, follows the same logic. The calculation is to provide facial payment experiences where people often shop, naturally growing the user base.

The ‘Capstone’ of Platform Expansion

Facial payment is more than just adding another payment method. As seen in the Toss Pay-GS25 and Naver Pay-Kyung Hee University campus examples, it can serve as a key tool for expanding the platform ecosystem. By integrating various services like automatic membership point accrual and discount application, it enhances user lock-in. Naver, already a powerhouse in the online platform space, seems poised to maximize O2O (Online to Offline) synergy through offline facial payments. Leveraging payment data could also unlock personalized marketing and new business models. Ultimately, for fintech companies, facial payment represents not just a transaction method, but a fresh opportunity to strengthen platform competitiveness.

Global Trends & K-Fintech’s New Frontier

Globally, facial payment is already a hot topic. Tech giants like China’s Alipay with ‘Smile to Pay’ and Amazon with ‘Amazon One’ are aggressively entering the market. Forecasts predict the facial payment market could grow by over 30% in 2025. The moves by Korean companies can be seen as an effort to keep pace with these global trends. Naver Pay’s campus implementation is particularly significant as it could serve as a testbed for global expansion, going beyond the domestic market. It’s worth watching whether K-Fintech can leverage facial payment technology to carve out new opportunities in the global market.

🎉 How Will Face Pay Change Our Lives?

Payment in the Blink of an Eye! Boosting Operational Efficiency

The biggest advantage of facial payment is speed. It reportedly cuts average payment time from 5 seconds to under 1 second – truly the blink of an eye. In fact, after introducing facial payments at Kyung Hee University’s cafeteria, lunchtime queues were reduced by 40%. For businesses, facial payment can significantly boost operational efficiency. It reduces cash handling tasks and can even cut down on card terminal maintenance costs. The benefits will be especially pronounced for businesses where turnover rate is crucial.

Leave Your Wallet at Home: Revolutionizing Customer Experience

For consumers, facial payment is pure convenience. No need to pull out a wallet or smartphone; just let the system recognize your face, and the payment is done. Systems like CU convenience store’s ‘Byself’ hint at a future where a single facial registration automates everything from store entry to checkout. With discounts and points applied automatically, could it get any more convenient? Facial payment is set to revolutionize the entire shopping experience, not just the transaction itself. Younger generations, known for their high adoption rates of new technologies and convenient services, are likely to embrace facial payment quickly, integrating it into their daily lives.

The Touchless Era: Embracing Hygiene and Accessibility

The preference for contactless payments surged after COVID-19. Facial payment perfectly meets this demand. Since payment occurs without touching a terminal, hygiene concerns are alleviated. Furthermore, facial payment can be much easier for people with disabilities or the elderly. It eliminates complex steps like inserting a card or entering a PIN; just face the scanner. Facial payment can contribute to creating more inclusive services for everyone.

🚧 Is It All Smooth Sailing? Technical Hurdles and Social Concerns

The biggest mountain facial payment needs to climb is security. Concerns about valuable facial data being potentially leaked or misused are understandable. Companies are well aware of these worries. Toss has implemented a distributed storage system, encrypting facial data and storing it across multiple servers. Naver Pay utilizes an AI-based Fraud Detection System (FDS) for 24/7 real-time monitoring.

However, technology constantly evolves, and hacking methods become increasingly sophisticated, demanding relentless security enhancements. A security breach could be devastating to a company’s image, and trust, once broken, is incredibly difficult to rebuild.

✨ Face Pay: A Bright Future Ahead?

Beyond Payment: The Infinite Expansion of ‘Face’

Facial payment is expected to expand into various domains like movie theaters, public transit, and healthcare. Toss has already enabled facial authentication instead of passports and boarding passes at departure gates and boarding gates (for select partner airlines) through the Incheon International Airport Smart Pass system. Naver Pay is preparing to extend its service to theme parks and airports.

Facial recognition technology isn’t limited to payments; it has potential applications in access control, identity verification, and more. The scope for using facial information is vast. We might be heading towards an era where your face handles many aspects of daily life.

The Global Standards Race: Can K-Face Pay Go Global?

Toss has already obtained facial recognition standard certification and is preparing to enter the Southeast Asian market. Naver Cloud is packaging its AI facial recognition engine as a cloud service and expanding sales overseas. The facial payment technology sector has entered an era of global standards competition. Korean companies are expected to compete fiercely to secure technological advantages and preempt global standards. Watching how successfully K-Fintech’s facial payment technology performs in the global market will be an interesting point to follow.

🎯 Catching Two Birds: Convenience and Trust

For facial payment to successfully take root, technological maturity is a given, but securing consumer trust is paramount. Companies must alleviate consumer anxiety through transparent information disclosure and continuous security enhancements. The government needs to find a balance between innovation and privacy protection, establishing a sophisticated legal framework.

Facial payment isn’t just about adding another transaction method. It can be a crucial opportunity to build a foundation of trust in the digital transformation era. Creating a payment environment that is not only convenient but also safe and reliable, allowing consumers to use facial payment with peace of mind – this is the key to its success and the bedrock that will strengthen our society’s steps into the digital age.