According to the Credit Finance Association, Hyundai Card’s total domestic and international personal credit card spending reached ₩131.1224 trillion last year, a 10% jump year-over-year. Hyundai Card’s personal credit card market share hit a whopping 20.1%, overtaking Shinhan Card’s 19.4% to grab the number one spot.

Hyundai Card is also the undisputed frontrunner in the PLCC (Private Label Credit Card) market. They kicked things off with Emart in 2015 and have since forged partnerships with a ton of companies to launch PLCCs. Last year, they teamed up with big names like Korean Air, Genesis, SSG.COM, and Olive Young, rolling out a diverse lineup of PLCCs. What makes consumers so enthusiastic about Hyundai Card PLCCs? And how have PLCCs propelled Hyundai Card to the top of the market share rankings?

🔍 The Allure and Perks Captivating Consumers

Hyundai Card’s PLCC membership has seen explosive growth, surging from 1.19 million in 2018 to 4.78 million in 2022, a roughly 302% increase. The proportion of PLCC members within Hyundai Card’s total membership also skyrocketed from 11% to 47% during the same period, indicating phenomenal popularity. Furthermore, the churn rate for 16 Hyundai Card PLCCs is around 1.05% on average, which is about a third of the average churn rate for all card companies (around 3%), demonstrating high customer loyalty. This success wasn’t just by chance; it was made possible by Hyundai Card’s unique strategy, built on meticulously analyzed consumer data and market trends.

Broad Lifestyle Coverage: A Strategy of Diversified Partnerships

One of Hyundai Card PLCC’s biggest strengths is its diversified partnership strategy, leading to expanded lifestyle coverage. By collaborating with 19 partner companies, Hyundai Card has built a dense service network that permeates every aspect of consumers’ lives. They’ve nailed generational preferences, offering tailored PLCCs like ‘Naver Hyundai Card’ for the 20-somethings, ‘Costco Rewards Hyundai Card’ for the 40-somethings, and ‘Hyundai Mobility Card’ for the 50-somethings, just to name a few.

The key to this strategy is securing consumer touchpoints that a credit card company alone could never reach. It’s about naturally drawing in customers who are fiercely loyal to specific brands and turning them into Hyundai Card customers through the PLCC as a bridge. Hyundai Card’s PLCC lineup, intricately woven like a net, boosts customer satisfaction by offering a wide array of choices so consumers can pick a card that’s a perfect fit for them.

Redefining Premium Value: Injecting Premium Strategy into PLCCs

PLCCs used to be seen as prioritizing specific brand perks but falling short on premium services. But Hyundai Card blew up that stereotype by boldly injecting a premium strategy into PLCCs. The fact that Hyundai Card issues 9 out of 12 premium PLCC products with annual fees of ₩100,000 or more is a prime example of their aggressive push into the premium PLCC market.

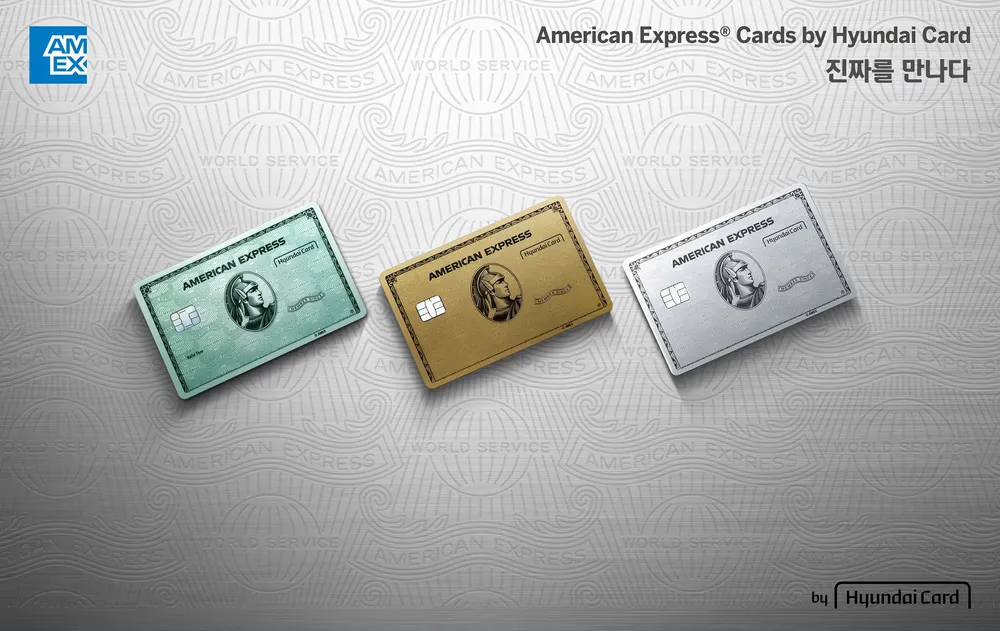

Collaborations with global premium brands like American Express have been crucial in elevating Hyundai Card PLCC’s premium image. High-end perks like overseas hotel bookings and airport lounge access precisely target the needs of consumers who want distinct value that goes beyond simple discounts or reward points. Ultimately, Hyundai Card has tapped into consumers’ desire for an everyday premium experience through PLCCs, attracting even greater demand.

🤝 Collaboration as Competitiveness: Building Strong Allies

Another cornerstone of Hyundai Card PLCC’s success is innovative marketing collaborations with other brands. They go way beyond just slapping logos on card designs, creating synergy across data, platforms, and branding, widening their lead over competitors.

Data Alliance: Opening a New Horizon for Cross-Marketing

Data is without a doubt the heart of Hyundai Card’s marketing strategy. The data alliance strategy, built on data sharing between partners, has been a game-changer in Hyundai Card’s dominance in the PLCC market. The explosive growth in collaborations, from just 64 in 2020 to 2,626 by July 2024, clearly shows how successful the data alliance strategy has been. As Hyundai Card Vice Chairman Chung Tae-young emphasized, “The key to PLCC success is building a customized data platform for each partner company.” Hyundai Card has developed True North, an AI-powered data marketing platform, to give its partners hyper-personalized marketing solutions.

PLCC partners can also team up for cross-marketing. The ‘3 Body-A Card’, which combines three PLCCs – Korean Air, Genesis, and SSG.COM – into a single card, is a perfect example. Analyzing and combining customer data to offer tailored perks and encourage customer cross-purchases has become standard practice for Hyundai Card. Hyundai Card’s ability to not just analyze data but to weave it into real-world product development and marketing is a powerful advantage that competitors can’t easily match.

Bold Alliance with Digital Platforms

Hyundai Card has been proactive in partnering with not just traditional industries but also digital platforms. The ‘Baedal Minjok Hyundai Card’, launched in 2020, was the first PLCC from a Korean food delivery app. It hit the bullseye on the MZ generation’s contactless consumption trends by offering high reward rates for Baemin Pay use on the Baedal Minjok app. The ‘Nexon Hyundai Card’ even unusually launched a debit card version, showing various efforts to broaden the subscriber age range.

These collaborations with digital platforms have been instrumental in Hyundai Card’s successful expansion into the younger customer demographic. By connecting with platforms that are second nature to digital natives, Hyundai Card has built a brand image that’s young and trendy, successfully securing future customers and bringing in new customers across different generations. In fact, the proportion of 20-year-olds among all new Hyundai Card members jumped by 8.7 percentage points, from 13.3% in 2019 to 22.0% in 2022.

📈 Data-Driven, Agile Strategy

Hyundai Card PLCC’s success is more than just a credit card market win; it’s a significant milestone showcasing the potential of data-driven marketing innovation. Hyundai Card’s proactive strategies, like partnership expansion and introducing premium services, offer valuable lessons for companies that need to quickly adapt to ever-changing consumer needs – which is how they climbed to the top spot in market share.

Ultimately, the key to Hyundai Card PLCC’s success is their laser focus on delivering differentiated value to consumers. Deeply understanding consumers through data analysis, capturing their hearts with compelling branding, and bringing it all to life with outstanding technology – that’s the secret behind Hyundai Card’s overwhelming success in the credit card market.